Court of Appeals has now held in a second published decision that the statute of limitations on a UIM claim begins to run when the insurer denies a claim for UIM coverage. I have addressed this issue of accrual multiple times over the years in this blog and my earlier blog the Kentucky Law Review, all to no avail. Click here for my most recent commentary which addresses some additional practical reasons in support of the decisions in Riggs and Hensley below.

When applying the statute of limitations to a contract action sounding in tort you are presented with a hybrid of analytical frameworks, neither of which seem to look at it from the insured’s perspective – eg. tort law for car collisions (2 years from date of accident or date of last pip payment, whichever is later) vs. contract (written contracts are 15 years) coupled with the fuzzy standard that an insurance company can unilaterally shorten the period if it is reasonable and not a violation of public policy. We now have the Court of Appeals taking a look at the rules and conditions behind the statute of limitations and applying both common sense and legal analysis.

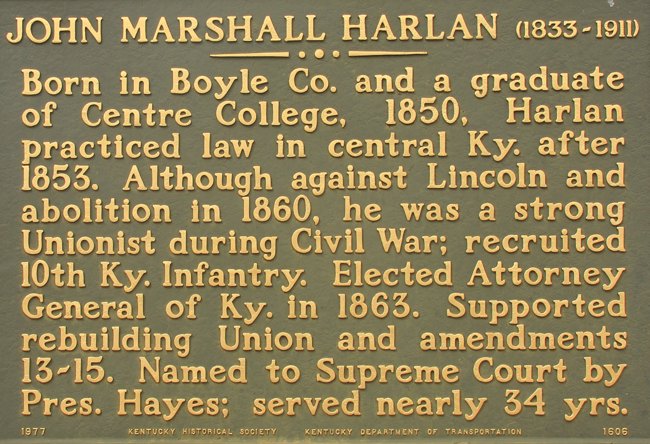

Supreme Court Justice John Marshall Harlan, born in Boyle County. Marker outside of court house in Danville, Kentucky.

In order to be time barred, you need a start date and and end date. The end date is clear – suit filed, yes or no? Start date until now has been applied illogically since the start date for a tort action is not the same as a contractual action, especially a contractual action premised upon an accrual date that has no reasonable relationship with the underlying tort.

Two panels and four Court of Appeals judges get it. The first panel held that the the contractual provisions of an insurance policy requiring any action for UIM benefits must be brought within 2 years of accident or last PIP payment paid was unreasonable (see, Riggs v. State Farm Mut. Ins. Co. , COA Published 7/19/2014 (Judges Acree writing the majority joined by Judge Taylor, with Judge Vanmeter dissenting), pending discretionary review 2013-SC-000555). Counsel for Mr. Riggs is Louisville personal injury attorney Timothy McCarthy; counsel for State Farm at the Supreme Court is David Klapheke.

Now a second panel has seen the real issue in Hensley vs. State Farm Mutual Ins. Co. and held simply that the statute of limitations on a UIM claim begins to run when the insurer denies a claim for UIM coverage. Judge Jones, joined by Judge Acree (who authored the Riggs decision) wrote a logically flowing decision addressing the problem of contracts vs. torts, the policy and statutes of Kentucky, the approaches from other states and then followed the majority rule, one of reason and sense. Judge Moore respectfully dissented but offered nothing specifically addressing the facts, the policy, or the arguments of counsel for Hensley. Counsel for Hensley is Louisville personal injury attorney Brian E. Clare with insurance lawyer Deborah C. Myers representing State Farm.

As noted by Judge Jones, the courts have gone down three paths –

(1) the date that the insurance company allegedly breaches the insurance contract by denying the insured’s UIM claim;

(2) the date of the accident; or

(3) the date that the insured settles with or obtains judgment against the tortfeasor, thereby exhausting the limits of the tortfeasor’s liability coverage.

* * *

The overwhelming majority of jurisdictions that have confronted this issue have concluded that a UIM claim accrues when the insurer breaches the insurance contract by denying the insured’s claim for benefits.10 The reasoning behind this theory is that because a claim for UIM benefits is a first-party claim, based in contract instead of tort, the limitations period begins to run on the date that the insurance contract is breached. Generally, these courts have determined that the insurer breaches the contract when it denies the insured’s claim for UIM benefits.

Judges Vanmeter and Moore dissented with sparse reasoning to support that dissent, eg. from Judge Moore:

Respectfully, I disagree with the majority opinion. Rather, my view aligns with the dissenting view expressed in Riggs v. State Farm Mut., Ins. Co.,—S.W.3d—, 2013 WL 3778143 (Ky. App. July 19, 2013)(2012-CA-000354-MR),18 stating that “a time limitation that dovetails with the limitation contained in KRS 304.39–230 is reasonable and comports with public policy.” Id. at *5 (citing Pike v. Gov’t Employees Ins. Co., 174 Fed.Appx. 311, 316 (6th Cir. 2006)). Moreover, I agree with the trial court in this matter that “there is a solid line of case law in Kentucky that upholds the validity of contractual terms that provide for shorter limitation periods than the general statute of limitations.” (Trial court opinion at page 3) (quoting Webb v. Kentucky Farm Bureau Ins. Co., 577 S.W.3d 17, 19 (Ky. App. 1978)). Accordingly, I would affirm.

To support stating neither dissenter has provided a reason you will note readily that a general rule is juxtaposed against a nonspecific line of cases without addressing the facts in the case and thus the dissents offer little or no guidance to automobile accident injury lawyers than a vague and nonspecific disagreement

Underinsured motorist benefits, Statute of Limitations Accrual

Hensley vs. State Farm Mutual Ins. Co.

COA, Published 8/15/2015; Judge Jones Reversing and Remanding, Jefferson County

This appeal requires us to consider when the statute of limitations begins to accrue on an underinsured motorist (“UIM”) claim. For the reasons more fully explained below, we hold that the statute of limitations on a UIM claim begins to run when the insurer denies a claim for UIM coverage. While an insurer can shorten the limitations period by contract, KRS1 304.14-370 operates to prevent a foreign insurer from relying on policy provisions that bar claims filed less than a year from the accrual of the cause of action. Under both the policy terms at issue and the common law of Kentucky, the UIM claim in this case did not accrue until November 4, 2011, when State Farm denied Hensley’s claim, less than a year before this action was filed. Accordingly, the Jefferson Circuit Court erred when it concluded that this action was time-barred. As such, we reverse the circuit court’s summary judgment in favor of the Appellee, State Farm Mutual Automobile Insurance Co. (“State Farm”), and remand this action to the circuit court for adjudication on the merits.