This week’s Court of Appeals decisions numbered 484 to 504, with 21 decisions; 4 of which have been designated “to be published”. COA addressed the consolidated appeal in the Louisville Zoo train accident involving issues of sovereign and qualified official immunity of zoo director and others in personal injury claim; the proper and timely filing of a claim against decedent’s estate; “owned but not scheduled for coverage” exclusion being unenforceable in automobile policy for underinsured motorist benefits (followed SCOKY and not unpublished COA decision); discovery rule in legal malpractice case for statute of limitations; suit against lawyer regarding loan agreement and proceeds from personal injury settlement.

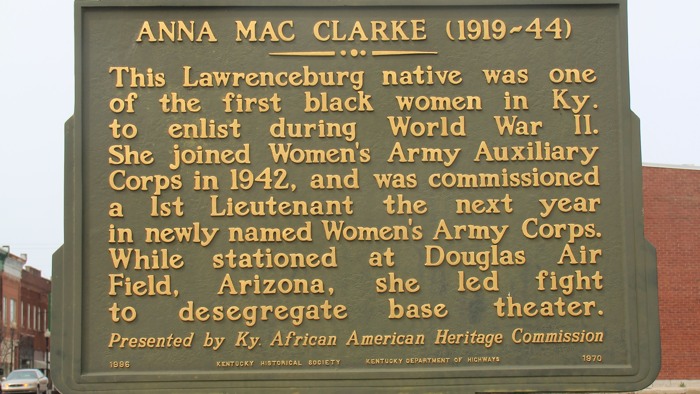

Historical marker in front of the Anderson County Court House in Lawrenceburg, Kentucky. Photo by Michael Stevens, 4/14/2013

Each of the following published decisions for the week of June 6, 2014 can be directly accessed below:

- 492. Louisville Zoo Train Litigation; qualified official immunity for zoo director

Rivera v. Lankford

COA, Published 6/6/2014 from Jefferson County - 496. Decedent’s estates and timely filing of claim

Terry Williams vs. Ralph William Turner

COA, Published 6/6/2014 from Harlan County - 499. Criminal Procedure (Miranda and Fifth Amendment Rights), self-incrimination

Ronald Estill Hill vs. Commonwealth of Kentucky

COA, Published 6/6/2014 from Fayette County - 500. Underinsured Motorist Benefits, Exclusion for vehicle available for insured’s regular use

Richard Tryon vs. Encompass Indemnity Company

COA, Published 6/06/2014 from Jefferson County

Click here for links to all the archived Court of Appeals minutes.

The Tort Report – Selected decisions this week on tort, insurance and civil law.

485. Legal Malpractice Statute of Limitations; Documents Stricken For Failure to Timely Produce

Housing Plus, Inc. vs. Estate of Paul Donaldson Ross, Sr.

COA, Not Published, 6/6/2014 from Fayette County

MOORE, JUDGE: Housing Plus, Inc., appeals the order of the Fayette Circuit Court dismissing its legal malpractice claim against the Estate of Paul Donaldson Ross holding that the action was filed outside the applicable statute of limitations. The circuit court’s order also granted Ross’s motion for summary judgment and granted a motion to strike several documents relied on by Housing Plus that were not timely produced. After thorough review of the record, we affirm.

Based on the evidence in the record, we agree that summary judgment was appropriate. The documentary evidence produced related primarily to the delinquent property taxes, but we have already determined that any claims made on that basis of liability were not brought within the applicable statute of limitations. Housing Plus failed to produce any affirmative evidence creating a genuine issue of material fact relating to any of the allegations against Ross of fraud, negligent misrepresentation, or professional malpractice contained in its complaint. Accordingly, Ross was entitled to judgment as a matter of law.

492. Louisville Zoo Train Litigation; qualified official immunity for zoo director

Angel Rivera vs. Christopher D. Lankford, et al

COA Published 6/6/2014 from Jefferson County

Note this case was consolidated with many parties, many issues involving sovereign immunity and qualified official immunity relative to multiple parties associated with the Zoo and the liability of the foundation.

ACREE, CHIEF JUDGE: On June 1, 2009, Train #312 (the “Green Train”) at the Louisville Zoo overturned, resulting in varying degrees of injury to its operator and most of the train’s twenty-nine passengers. Numerous lawsuits were filed against a host of entities and individuals, including the Louisville Jefferson County Metro Government (Louisville Metro), the Louisville Zoo Foundation, eleven zoo employees, and Chance Rides Manufacturing, Inc.1 Most of those cases settled; a few did not. We reverse that part of the Jefferson Circuit Court’s November 16, 2012 Opinion and Order that held John Walczak was entitled to qualified official immunity. The remaining holdings of that order regarding liability and immunity of the various defendants are affirmed.

498. Loan Agreement With Injury Claim as Security; Attorney’s Distribution of Funds; Tortious Interference with Contract

Thomas Armistead vs. William J. Grider

COA, Not Published 6/6/2014 from Jefferson County

CLAYTON, JUDGE: This is an appeal from a decision of Division 12 of the Jefferson Circuit Court following a bench trial. Based upon the following, we affirm the decision of the trial court.

Grider drafted a Loan Repayment Agreement for the loan between Cave and Armistead which set forth as follows:

In consideration for loaning me the sum of $21,000.00, I, Jeffrey Cave, hereby direct my attorney, Jon Grider, to pay the sum of $21,000.00 to Tom Armistead out of any settlement funds I receive as a result of claims I have pending in connection with a motor vehicle accident which occurred on November 20, 2006.

The Agreement was signed by Cave in the presence of Grider on April 18, 2007. On November 6, 2007, Grider deposited Cave’s settlement proceeds into his escrow account and on November 9, 2007, Cave came to Grider’s office for disbursement of the funds. At that time, Grider distributed to Cave all the funds except his fee. Grider asserts that he asked Cave whether he should distribute the funds to Armistead or directly to Cave. He also testified that he suggested Cave give $10,000.00 of the proceeds immediately to Armistead. Cave, however, testified that he did not want the money to come directly from him and that it was Grider’s idea to pay him the entire sum.

In determining that Grider had not tortiously interfered with the Loan Agreement, the trial court held as follows:

To prevail on a tortious interference of contract claim, Armistead must plead and prove six elements: (1) the existence of a contract; (2) Grider’s knowledge of the contract; (3) Grider’s intent to cause the breach of the contract; (4) Grider caused one party to the contract to breach the contract; (5) the breach caused damages to the non-breaching party to the contract; and (6) Grider acted with malice toward the non-breaching party to the contract.

COA affirmed the trial court holding no tortious interference with the loan agreement by the attorney and the person loaning the money was not a third party beneficiary to the contingent fee agreement.

500. Underinsured Motorist Benefits, Exclusion for vehicle available for insured’s regular use

Richard Tryon vs. Encompass Indemnity Company

COA, Published 6/06/2014 from Jefferson County

STUMBO, JUDGE: Richard Tryon appeals from an order of the Jefferson Circuit Court granting summary judgment in favor of Encompass Indemnity Company and Philadelphia Indemnity Insurance Company. The circuit court found that Encompass and Philadelphia Indemnity did not owe underinsured motorist benefits to Mr. Tryon. We find these two companies were not entitled to summary judgment; therefore, we reverse and remand.

In the case sub judice, we find that the trial court erred in relying on Hartley [Motorists Mutual Ins. Co. v. Hartley, 2010-CA-000202-MR (Ky. App. Feb. 11, 2011) ] and that it was NOT controlling in this case because that is an unpublished opinion and is not binding precedent. CR 76.28(4)(c). We are bound by the Chaffin and Dicke opinions which hold that the “owned but not scheduled for coverage” exclusion is unenforceable as against public policy.. We believe the cases of Chaffin v. Kentucky Farm Bureau Ins. Companies, 789 S.W.2d 754 (Ky. 1990), and Allstate Ins. Co. v. Dicke, 862 S.W.2d 327 (Ky. 1993), both Kentucky Supreme Court cases, are the controlling precedent.

For a complete copy of this week’s decisions (minutes) of the Kentucky Court of Appeals with links to the full text of each published and nonpublished decision then click continue reading below.

[gview file=”http://apps.courts.ky.gov/Appeals/Minutes/MNT06062014.pdf”]